What is depreciation in taxes?

Depreciation refers to how much an asset decreases in value over time. You can deduct this depreciation, therefore reducing your tax liability.

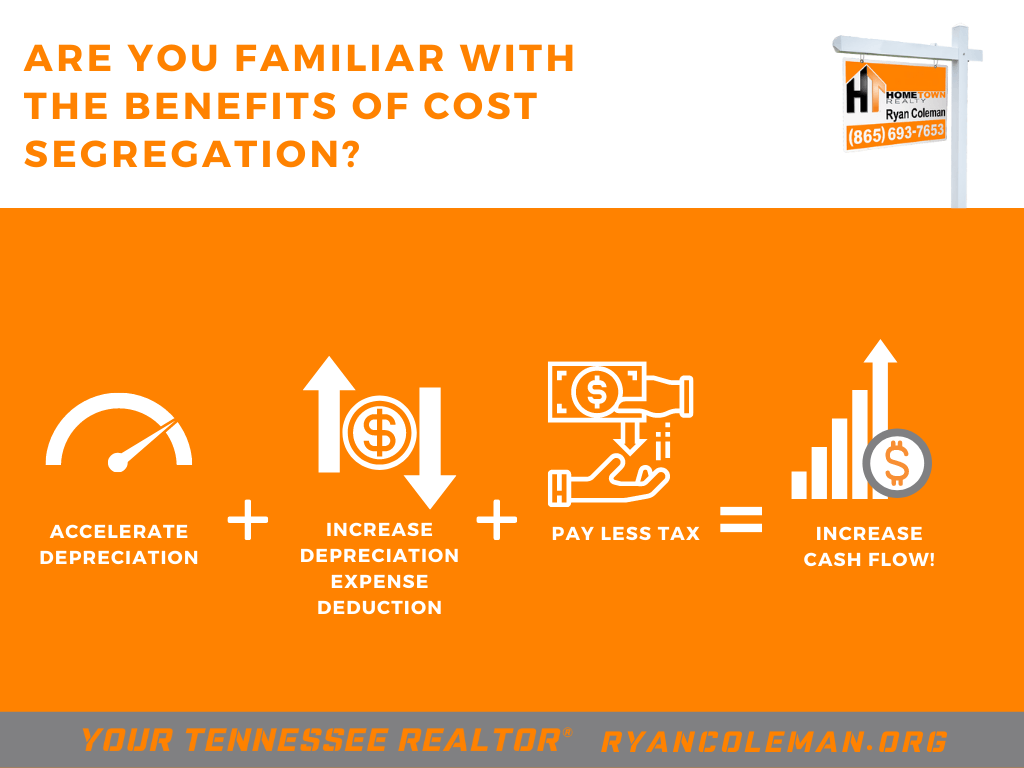

Generally, when you place a rental property into service, the land and building values are separated based on what the county assessor has determined. Then the building portion is depreciated over 27½ years (residential property) or 39 years (commercial property). The term “building” is a bit misleading because it generally includes a lot more than just the building. While the building value does include structural components, it also includes light fixtures, cabinets, fences, flooring, and other items that have a much shorter life than 27½ years—especially in rentals. With cost segregation, you can reclassify a portion of your assets as personal property instead of real estate property to depreciate them on a much, much faster schedule for tax purposes. This strategy is also referred to as “accelerated depreciation.” It’s a great tax planning strategy used by real estate investors to reduce their current tax liability and increase cash flow.

How does it work?

Cost segregation studies should be completed by a professional who can give the analysis and consider the effects on taxes. You will need to do the work to find them and then pay them a fee, usually $10,000–$12,000, but this might be a small piece of your eventual profit. The professional will examine certain interior and exterior components of the property and assess their value and expected depreciation.

Cost segregation studies are worth the extra work. They can save you thousands of dollars on your tax bill each year.

Is cost segregation right for you?

Cost segregation benefits multifamily property investors or commercial property investors the most, especially those who hold the properties long term. It is a strategy that takes time.

It’s important to make sure you can actually take the deduction for the accelerated depreciation. Also, double-check that the benefit of cost segregation will be greater than the cost of the study.

Find a tax professional to assist you in cost segregation, especially one who will weigh the pros and cons of your individual situation.

When should a cost segregation study be conducted?

A cost segregation study can be conducted anytime after the purchase or remodel of the property. For maximum tax benefits, it’s important to do the study within the same year as purchasing or remodeling it.

Let Us Help You!

Are you looking to buy or sell a home in Knoxville, Tennessee? Please don’t hesitate to reach out to Ryan Coleman and our team at Hometown Realty as a trusted source for up to date real estate information in the East Tennessee area!

865-693-SOLD